The Facts About

California’s

Climate Programs

30 CENTS PER GALLON*

11 CENTS PER GALLON**

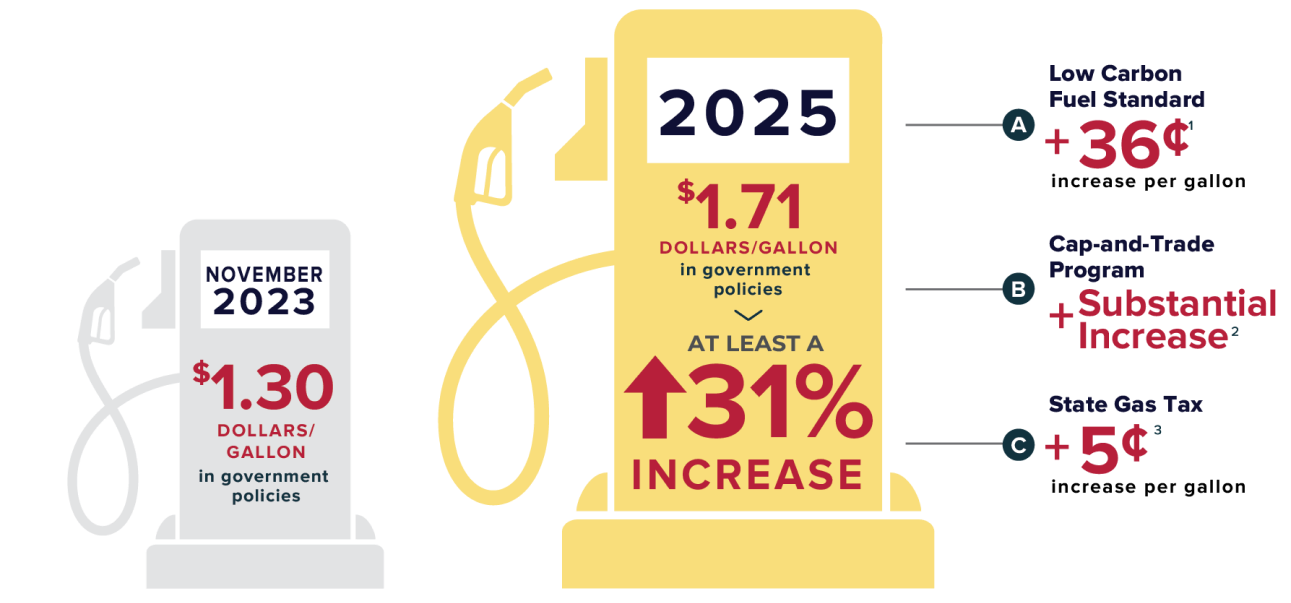

The costs for these

programs are heading up

*SOURCE: California Energy Commission, OPIS West Coast Spot Market Report, Effective as of 6 November 2023

**Source: California Energy Commission, OPIS West Coast Spot Market Report, October 2023.

A) Low Carbon Fuel Standard 2023 Amendments Standard Regulatory Impact Assessment, Table 22

B) CA Air Resources Board, https://ww2.arb.ca.gov/our-work/programs/cap-and-trade-program/cap-and-trade-meetings-workshops, slide 8

C) SB 1 automatically increases the state excise tax based on the California CPI

*Based on May 2023 Auction Settlement Price for California Carbon Allowances. See California Cap-and-Trade Program – Summary of California-Quebec Joint Auction Settlement Prices and Results, May 2023 Joint Auction #35, available at: https://ww2.arb.ca.gov/sites/default/files/2020-08/results_summary.pdf. Accessed: July 10, 2023.

**Based on OPIS methodology, available at: http://www.opisnet.com/wp-content/uploads/2018/07/OPIS-California-Carbon-Allowance.pdf. Accessed: July 2023.

A) Low Carbon Fuel Standard 2023 Amendments Standard Regulatory Impact Assessment, Table 22

B) CA Air Resources Board, https://ww2.arb.ca.gov/our-work/programs/cap-and-trade-program/cap-and-trade-meetings-workshops, slide 8

C) SB 1 automatically increases the state excise tax based on the California CPI