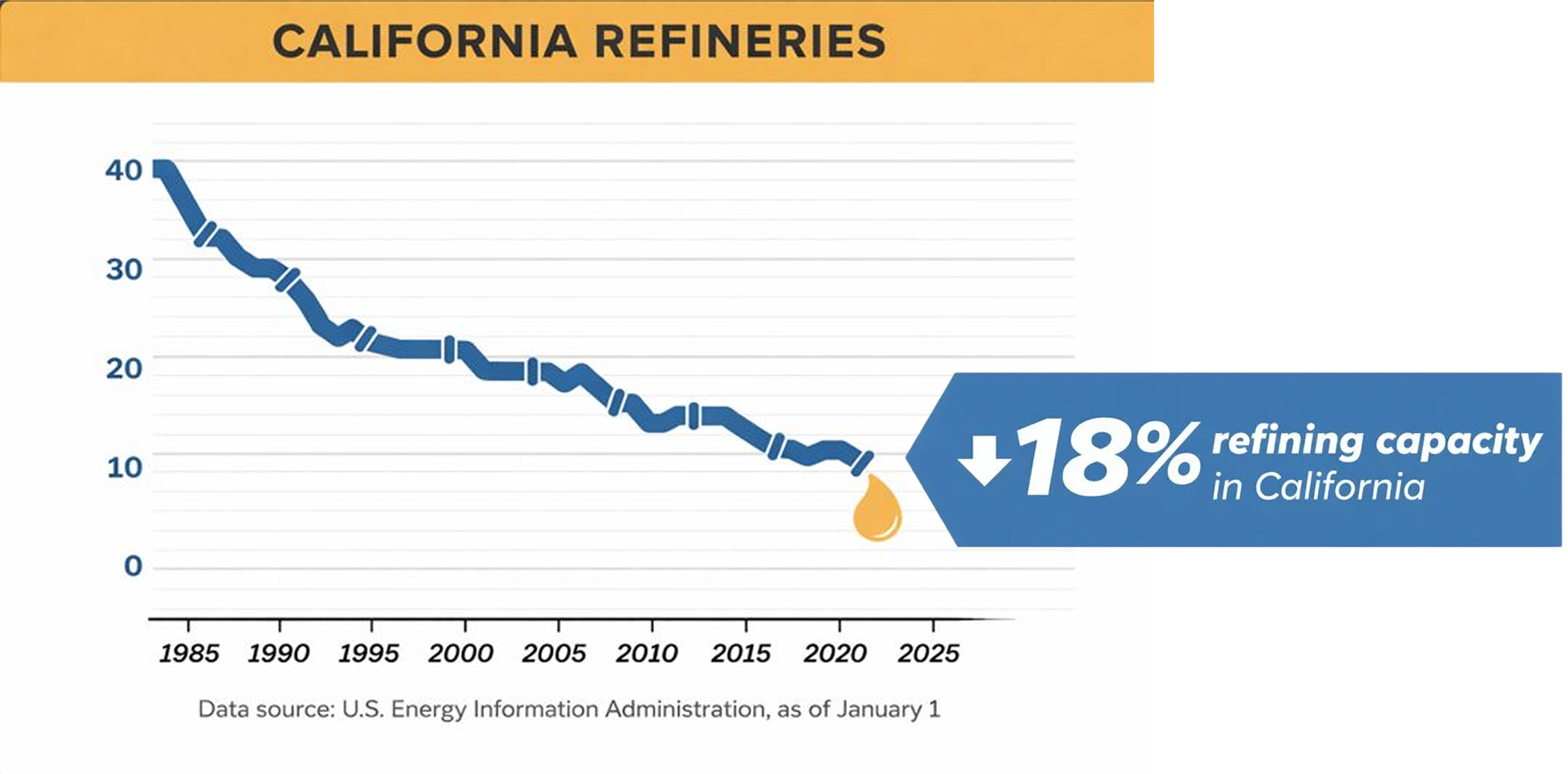

California is set to lose 18% of its refining capacity by Spring 2026

Two major California refineries are ceasing production, taking nearly one-fifth of the state’s refining capacity offline.

This loss of in‑state refining will tighten local fuel supplies and make California more dependent on fuel shipped in from elsewhere.

SOURCE: U.S. Energy Information Administration reported California refining capacity as of January 1

“I’m not sure I understand the argument for a windfall profits tax on energy companies. If you reduce profitability, you will discourage investment, which is the opposite of our objectives.”

“I’m not sure I understand the argument for a windfall profits tax on energy companies. If you reduce profitability, you will discourage investment, which is the opposite of our objectives.”