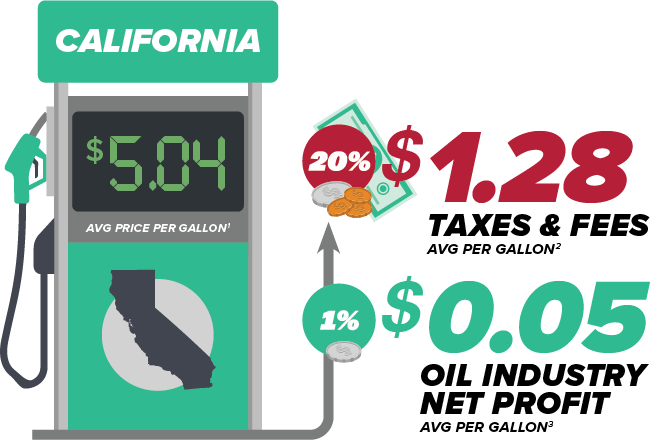

20% of what you pay at the pump went to taxes and fees (June - December 2023)

California lawmakers passed a new law last year to collect data to impose price controls on gasoline.

Seven months of that data has been collected and shows that 20% of what consumers paid at the pump went to government taxes and fees while only 1% was attributable to net profits from the oil industry.

SOURCES:

- Average of U.S. Energy Information Administration reported price per gallon for all grades all formulations from June – Dec 2023

- This figure represents the average sum of State Excise Tax, State and Local Sales Taxes and State Underground Storage Tank Fee collected by the California Department of Tax and Fee Administration; Low Carbon Fuel Standard based on OPIS methodology; Cap-and-Trade (Fuels under the cap) based on most recent Auction Settlement Price for California Carbon Allowances from for the months of June – December 2023

- Average of California Energy Commission reported profits for June – December 2023

“I’m not sure I understand the argument for a windfall profits tax on energy companies. If you reduce profitability, you will discourage investment, which is the opposite of our objectives.”

“I’m not sure I understand the argument for a windfall profits tax on energy companies. If you reduce profitability, you will discourage investment, which is the opposite of our objectives.”